Farmers Bank of Marion, Kentucky was chartered and opened for business on December 1, 1899. The original stockholders who established the bank with capital of $15,000.00 were E. W. Jones, S. S. Sullenger, J. B. Hubbard, William T. Fowler, Dr. R. L. Moore, E. J. Hayward, E. C. Moore, Dr. J. R. Clark, and P. B. Croft.

Farmers Bank of Marion, Kentucky was chartered and opened for business on December 1, 1899. The original stockholders who established the bank with capital of $15,000.00 were E. W. Jones, S. S. Sullenger, J. B. Hubbard, William T. Fowler, Dr. R. L. Moore, E. J. Hayward, E. C. Moore, Dr. J. R. Clark, and P. B. Croft.

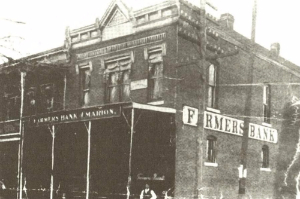

William T. Fowler, one of the founders of the bank, served as the first president of the bank. During his 25 year tenure, several significant events occurred whose influences are reflected in the bank today. On February 19, 1913, the board of directors of Farmers Bank approved the purchase of the building and lot, which the bank had occupied since its opening at 201 South Main Street in downtown Marion, Kentucky for $5,000.00. The owner of the bank building and lot was E. J. Hayward, one of the founders of the bank. "On Wednesday night, March 26, 1913, about 11:30 p.m., a fire, of unknown origin, was discovered in a vacant building adjoining the bank, which resulted in the complete destruction of the bank's building and furniture," save the vault. Farmers Bank operated from a room in James and James, until "a substantial bank building" could be constructed at the same location. At the November 29, 1913 regular meeting of the board of directors of the bank, it was reported that $9,985.00 had been spent on the new bank building, furniture, and fixtures. On Monday, October 20, 1919, the shareholders of Farmers Bank approved the reorganization of the bank as Farmers Bank and Trust Company of Marion, Kentucky, which allowed the "corporation to transact and carry on a trust business in addition to its banking business". On December 31, 1924, Mr. Fowler retired as president, but he continued as chairman of the board of directors until his death on December 30, 1928. Mr. Fowler is the longest serving president of the bank to date.

W. T. McConnell assumed the presidency upon the retirement of Mr. Fowler. Mr. McConnell joined Farmers Bank on December 1, 1913 as a vice president. He resumed his role as a vice president in 1930, in which he continued until his death on February 15, 1936.

O. S. Denny returned to Farmers Bank and Trust Company as its third president in 1930. Mr. Denny joined the bank on January 1, 1913 as the cashier and was elected to the board of directors on January 28, 1913. He had served as the cashier of Citizens Bank of Carrsville, Kentucky for ten years prior to joining Farmers Bank. On August 17, 1928, Mr. Denny resigned from the board of directors and as the cashier of Farmers Bank to become the Banking Commissioner of Kentucky. Governor Flem D. Sampson appointed him to this position, in which he served from July 1, 1928 to June 30, 1930. Mr. Denny's tenure was marked by The Great Depression and the effect that it had on our nation's banks, including banks in our community. On October 11, 1930, the shareholders of Farmers Bank and Trust Company approved a consolidation and merger with Marion Bank, with the new bank to retain the name of Farmers Bank and Trust Company. Between July 1, 1932 and June 30, 1933, Farmers Bank and Trust Company purchased the assets of Citizens Bank of Carrsville. In both of these transactions, Farmers Bank and Trust Company ensured that "no depositor [of Marion Bank or Citizens Bank of Carrsville] lost a single penny." During this period, Farmers Bank and Trust Company had the Carrsville Agency, which served the lending needs of the Carrsville community.

"As did all other banks in the entire country during the depression years, Farmers Bank and Trust Company issued preferred stock in order that it might protect itself and at the same time assume its responsibility for looking after the interest of its own community and county." On January 9, 1934, Farmers Bank and Trust Company's Articles of Incorporation were amended to allow the issuance of preferred stock, class A and B. The preferred stock, class A, was issued to the Reconstruction Finance Corporation, which was created by Congress in 1932 during President Herbert Hoover's administration. The preferred stock, class B, was issued to individuals. Another significant result of The Great Depression that we continue to appreciate is the establishment of the Federal Deposit Insurance Corporation (FDIC) by the Banking Act of 1933 during President Franklin Delano Roosevelt's administration. The FDIC originally insured deposits up to $5,000.00. Mr. Denny held the presidency until his death on July 13, 1937.

R. G. Fowler, the son of the bank's first president William T. Fowler, accepted the role of president of the bank on September 1, 1937, shortly after Mr. Denny's death. Mr. Fowler was serving as a director of the bank as early as 1934 and had been serving as a vice president of the bank since April 1, 1936. On October 1, 1938, the Carrsville Agency was discontinued and all of it cash, notes, records, etc. were transferred to Farmers Bank and Trust Company's Main Office in Marion. During a regular meeting of the board of directors on November 5, 1941, a representative of the Burroughs Adding Machine Company presented their new posting machines and systems of bookkeeping. Mr. Fowler served as president until his death on September 20, 1942.

R. G. Fowler, the son of the bank's first president William T. Fowler, accepted the role of president of the bank on September 1, 1937, shortly after Mr. Denny's death. Mr. Fowler was serving as a director of the bank as early as 1934 and had been serving as a vice president of the bank since April 1, 1936. On October 1, 1938, the Carrsville Agency was discontinued and all of it cash, notes, records, etc. were transferred to Farmers Bank and Trust Company's Main Office in Marion. During a regular meeting of the board of directors on November 5, 1941, a representative of the Burroughs Adding Machine Company presented their new posting machines and systems of bookkeeping. Mr. Fowler served as president until his death on September 20, 1942.

R. F. Wheeler accepted the presidency of the bank on January 12, 1943, shortly after Mr. Fowler's death. Mr. Wheeler began serving on the board of directors on January 2, 1918 and served as a vice president from January 1, 1923 until an unknown date between 1929 and 1935. On June 9, 1943, the board of directors approved closing the bank at 12 noon each Thursday, "thereby enabling the employees [of the bank] to participate in Victory Garden work." On October 14, 1944, the board of directors approved purchasing a second posting machine at a cost of $2,000.00. Mr. Wheeler's tenure saw the conversion of the bank's preferred stock, class B, to common stock as per a special shareholders' meeting on November 18, 1946. Mr. Wheeler retired as president of the bank on January 13, 1948, but continued to serve on the board of directors until his death on August 13, 1966.

John Quertermous assumed the role of president upon the retirement of Mr. Wheeler. Mr. Quertermous had served as the president of Salem Bank of Salem, Kentucky from January 8, 1935 to January 1, 1948. In 1946, Governor Simeon Slavens Willis appointed Mr. Quertermous as the Kentucky Department of Welfare Commissioner, in which capacity he served until he accepted the presidency of Farmers Bank and Trust Company. Mr. Quertermous' tenure saw the retirement of the bank's preferred stock, class A, by December 31, 1948 as per the special shareholders' meeting on November 18, 1946 and a regular meeting of the board of directors on December 11, 1947. On October 19, 1950, the board of directors authorized the bank to begin offering Christmas Savings Accounts for 1951. On March 12, 1953, the board of directors authorized the bank to close on Wednesday afternoons, during the summer months. A minimum hourly wage of $1.00 became effective on May 1, 1956. On April 27, 1956, the board of directors approved the purchase of Carrier air conditioning equipment for the bank at a cost of $1,799.00. Mr. Quertermous held the presidency until his death on February 12, 1958.

Hollis Charles Franklin accepted the presidency of the bank on February 20, 1958. Mr. Franklin joined the bank on July 1, 1918 and was an assistant cashier as early as February 8, 1919. He served as the executive vice president of the bank from January 8, 1946 until he assumed the president's role. Mr. Franklin held the presidency until his death on December 2, 1958.

Homer Glenn McConnell, the son of the bank's second president W. T. McConnell, accepted the presidency of the bank on January 13, 1959. Mr. McConnell first served the bank as an assistant cashier, from December 31, 1928 to 1939. In 1939, he became Postmaster of the Marion Post Office, in which capacity he served until his death on November 22, 1960. On March 12, 1959, the board of directors authorized the re-opening of the trust department. Mr. McConnell held the presidency until his death.

Samuel A. Guggenheim, Jr. assumed the role of president on January 12, 1961, shortly after Mr. McConnell's death. Mr. Guggenheim began serving the bank as a director prior to April 4, 1934. He retired as the president of the bank on January 15, 1970, continuing to serve as the chairman of the board of directors until his death on August 2, 1981.

H. Douglas Sullenger accepted the presidency of the bank upon Mr. Guggenheim's retirement. Mr. Sullenger joined the bank on September 9, 1946 and was elected to the board of directors on October 9, 1958. He served as the first trust officer when the trust department was re-opened in 1959 and continued in that role until his retirement as president. In 1972, the bank initiated an expansion and renovation project of the bank building, which doubled its size. On November 30, 1975, the bank began converting its transaction processing and posting to Computer Services, Inc. in Paducah, Kentucky. On September 1, 1987, the shareholders of Farmers Bank and Trust Company approved the formation of Farmers Bancorp, Inc., a holding company with Farmers Bank and Trust Company as its wholly owned subsidiary. The formation of the holding company provides the bank with the flexibility to respond to the changes in the rapidly evolving financial services industry. In 1989, the bank initiated an expansion and renovation project of the bank building, which doubled its size again and included the bank's first automated teller machine. From 1972 to 1989, the total assets of the bank had grown fivefold as had the cost of the expansion and renovation project. After retiring from the presidency on December 31, 1993, he continued as the chairman of the board of directors until December 31, 1996.

Gareth W. Hardin assumed the role of president of the bank upon Mr. Sullenger's retirement. Mr. Hardin joined the bank on August 24, 1987 and was elected to the board of directors on December 15, 1988. On July 16, 1998, Farmers Bank and Trust Company opened its second location at 203 North Main Street, a drive-thru branch with a lobby and a drive-thru full service automated teller machine. On July 22, 1998, the bank ended a tradition that had started over 45 years earlier: the drive-thru branch opened for its first Wednesday afternoon. On June 25, 1998, Farmers Bank and Trust Company launched the MasterMoney debit card, which serves as an automated teller machine or cash card and as a check or debit card. Another milestone for Farmers Bank and Trust Company occurred on January 1, 2010 when Mr. John Wade Berry became the 12th President of Farmers Bank. This was followed by another change on January 1, 2011 when Mr. Berry was also named Chief Executive Officer. Mr. Berry has been employed at the bank since September 22, 1993 and has served on the bank's board of directors since 2007.

On Tuesday, April 16, 2002, Farmers Bank and Trust Company celebrated yet another major milestone, as the total assets of the bank reached the $100 million mark for the first time. On Monday, April 14, 2003, Farmers Bank and Trust Company opened its third location at 216 West Main Street in downtown Salem, KY, which was its first location outside of Crittenden County and its second full service location with a lobby, drive-thru windows and a drive-thru full service automated teller machine. Our fourth location and second location outside of Crittenden County was our Henderson Office, which opened June 8, 2015, followed by our fifth location in Madisonville, KY on April 25, 2016.

On Tuesday, April 16, 2002, Farmers Bank and Trust Company celebrated yet another major milestone, as the total assets of the bank reached the $100 million mark for the first time. On Monday, April 14, 2003, Farmers Bank and Trust Company opened its third location at 216 West Main Street in downtown Salem, KY, which was its first location outside of Crittenden County and its second full service location with a lobby, drive-thru windows and a drive-thru full service automated teller machine. Our fourth location and second location outside of Crittenden County was our Henderson Office, which opened June 8, 2015, followed by our fifth location in Madisonville, KY on April 25, 2016.

During 2019, the bank expanded its borders yet again with the acquisition of First State Bank, which serves three counties, McLean, Muhlenberg, and Warren. The five new offices located in Livermore, Calhoun, Central City, Greenville, and Bowling Green greatly complimented the culture of the bank and the types of communities the bank was accustomed to serving.

As we look back at more than 100 years of serving our communities, we look back with admiration and appreciation to each director, officer, and employee whose dedication, diligence and sacrifice made the vision of nine men a reality that has touched countless lives. They have transformed a $15,000.00 investment in 1899 into an institution with over $600 million in total assets in 2023. Our directors and employees consider it an honor and a privilege to continue this rich history by serving those who have made it all possible, OUR CUSTOMERS and OUR SHAREHOLDERS.